Business Succession & Exit Planning

The sale or transition of your business will likely be the single largest and most important financial transaction of your life………and it’s level of success will significantly impact how you approach your next great adventure.

20%

Only 20% of businesses listed for sale ended up being sold.

The majority of them did not sell for what the owners initially thought they were worth.

Are you thinking of selling or exiting your business?

Mapping out a successful plan to exit the business can help you:

Avoid unnecessary or excessive taxes

Minimize risk during the transition

Realize the full value of your life’s work

Build/preserve your legacy

The failure to plan and manage succession well is the greatest threat to the survival of a business:

50% of businesses transition involuntarily - typically because of one of more of the 5 D's - Death, Disability, Divorce, Disagreement or Distress

Yet…..most business owners have up to 80% of their financial assets tied up in their business.

And....still 70% of business owners have no transition plan at all

The key to exit planning is that it isn’t actually about the exit itself…….it’s about getting you and the business ready to transition at any point in time.

THE FOUR PRIMARY OPTIONS FOR SUCCESSION/EXIT

1.

Transition or sell to family member(s)

Statistics show that 50 percent of typical business owners want to transfer their business to their children. In actuality, this happens with less than one-third of businesses. Because this option has a low success rate, a business owner considering this must also develop a contingency plan that involves transitioning the business to another type of buyer.

Advantages:

Personal goal……keeping the business and family together (family legacy).

Could provide financial well-being and a career to younger family members unable to earn a comparable income from outside employment.

Could allow the original business owner to stay actively involved in the business with their children.

Could provide to the owner the luxury of determining how much he wants for the business.

Disadvantages:

May create or increase family discord and feelings of unequal treatment among siblings.

Family members cannot usually afford to pay cash at the business closing. As a result, the selling family member has to accept payment for the business over time.

Financial security and business performance is often diminished over time (especially if the buying family member cannot run it properly).

Family dynamics and issues may diminish the new owner’s control over the business and it’s operations significantly.

2.

Sell to employee(s), current managers or other shareholders

The business owner can sell all or part of the business to the company’s management team (or part of the team). This is done either as a Management Buyout (MBO) or Leveraged Buyout (LBO). In these cases the management team uses the assets of the business to finance a significant portion of the purchase price. If the business owner wants to sell the business to the company’s employees rather than just the management team, an Employee Stock Ownership Plan (ESOP) may provide a good means of cashing in a part of the owner’s interest in the business.

Advantages:

The business stays in the “extended family” who are familiar with it.

Fellow shareholders, current managers and/or employees don’t have to be convinced of the value of the business.

Less risk because the management team and key employees may not be disrupted and can continue to operate as they always have.

The shares for the ESOP are bought with pre-tax dollars and an ESOP is an employee benefit.

Owning shares in a company usually makes employees think and act like owners and increases their productivity.

Disadvantages:

The departing owner may be locked into selling his/her shares only to fellow shareholders, creating a limited market and depressing the company’s value.

Owners may receive little or no cash from the sale up front.

May require the participation of an outside investor, which could cause cultural or management-style conflicts.

For ESOP’s they’re typically complicated and expensive to set up and maintain, and they’re generally suitable only for a gradual exit over time.

3.

Sell to a third party

A sale of a business to a third party can take many forms with the 2 main types being financial & strategic buyers. Financial buyers are typically looking for an existing business to run (rather than start it from scratch). Strategic buyers may be a competitor, customer, or supplier in the same industry. Or they may be a private equity group, venture capital firm or institutional investor. Strategic buyers typically see the potential for greater value by purchasing a company in a similar/adjacent market.

Advantages:

Sellers often receive a majority (or all) of the purchase price in cash at closing.

Typically results in the highest valuation for a business compared to other options.

Offers a seller the potential of access to buyers with a strategic or synergistic motive for buying the business.

Could be the best option for a business that is too valuable or too high-priced to be purchased by someone in the “extended family”.

Disadvantages:

An owner who desires to stay on after the sale to a third party may find herself/himself in the role of employee rather than owner, which can be very difficult.

Many times, these arrangements require the seller to finance a portion of the purchase price with a seller note. If little or no exit planning was done and the company isn’t properly prepared for sale, this could expose the seller to risk.

This process typically takes 9-12 months (or more) to execute.

Could result in the loss of customers and key employees.

4.

Close the business (liquidation)

If there is nobody interested in buying a business, it may have to be shut down and all assets liquidated. In liquidation, the owner sells their assets, collects outstanding accounts receivable, pays their bills, and keep what remains, if anything, for themselves. Liquidation typically makes sense only if a business lacks sufficient income-producing capacity to support the investment required in the company’s assets. If the value of the assets is higher than the value of the business cash flow, nobody will pay more for the business than the value of the assets.

Advantages:

The process is fairly simple and fast.

The entire company doesn’t have to be liquidated. The owner may decide to liquidate only a portion of the company and keep the more profitable parts intact.

Disadvantages:

Liquidation usually results in the lowest possible value for a business because it reflects the fair market value of only the assets with no consideration for client or customer lists, employee knowledge, name or reputation, or any of the other intangible assets of the business.

The cost of liquidating a company is almost as high as the cost of selling an operating business.

Employees and managers lose their jobs, and this has a negative impact on customers, vendors and the local community.

Any legacy and business value created over a long period of ownership of the business, disappear upon liquidation.

INGREDIENTS FOR A SUCCESSFUL BUSINESS EXIT

A successful business exit strategy includes 5 key ingredients:

A thought out strategy that includes; owner's personal plans for what they will do after transitioning out, owner's personal financial plan and a plan to grow the value of the business while de-risking it at the same time

A team of professional advisors to each help with their areas of expertise (Business Coach, Attorney, CPA/Accountant, Financial Advisor, Banker, Insurance Advisor, Business Broker, etc.)

Owner working toward becoming independent of the business (so it can run without her/his involvement)

A strong management team

Enough time to prepare for a successful exit (typically planning 2-5 years, minimum, in advance of an exit…..the more time prior to the owner’s transition date, the better)

WHEN IS A GOOD TIME TO SELL?

Timing is everything!

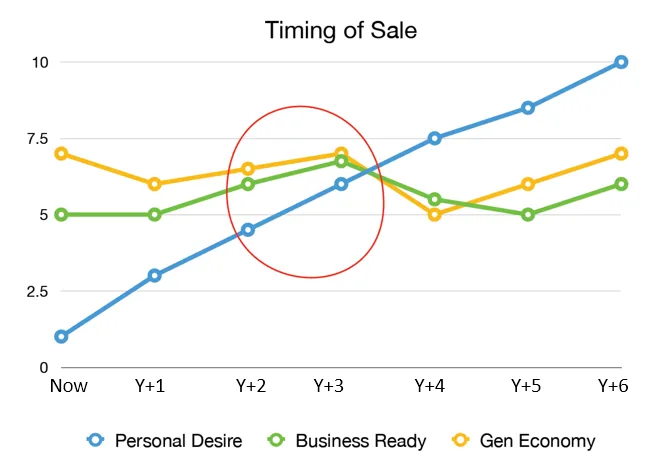

Timing is different for every business, but ideally the opportune time is where personal desire, business readiness and the state of the economy line up for the perfect storm to maximize your value.

Personal desire (blue line) most like will increase steadily each year that passes. As the owner gets older, the more mentally ready they become, and hopefully financially ready as well.

Business readiness (green line) will hopefully follow a similar trend, but it’s not uncommon that as an owner gets older, their desire to work hard or to innovate or change decreases so the business may become more ready or it may decline. ---- HERE’s where coaching can help. Guiding the owner through this process can drastically increase the speed and total value of the business.

Economy (yellow line) As a coach, we can help the owner evaluate the market/economy, we can’t control it but we can help monitor it with our clients and identify strong economic factors to help plan the right timing.

Owners wanting to transition out must increase the value of their business and be taking the following steps to do this now

Training employees

Developing managers

Documenting systems

Increasing sales and profits

Developing long-term customer relationships and recurring revenue

Creating a competitive advantage

Building a business that doesn’t need you to be in it to be successful

Exit planning is urgent & important!

This process often takes 2-5 years to prepare yourself and the business for a successful transition.

Build Your Succession/Exit Dream Team

FocalPoint Coach

Your coach will be your team captain to help you find and vet out the best resources for your business and build an action plan to get you full value for your business.

Financial Advisor

Your financial advisor will help manage the estate plan for your personal gain from the sale of the business. You will need one with experience in the sale/transfer of business assets to personal assets.

Lawyer

Finding a good lawyer is essential to coordinate all of the agreements, contracts and documents to ensure all the t's are crossed and i's are dotted. This is vital to protect you and your legacy.

CPA

Ideally, you already have a CPA you are working with, but you will need to double-check their qualifications to help manage through a succession and exit. Sometimes it is necessary to hire a new firm who can better support transition-related activities.

Business Broker

If you make the decision to sell your business, a well-connected business broker will market the company broadly to generate interest and ensure you receive adequate value for your business.

If you need recommendations, contact me, I have a Trusted Referral Network with all of the team members you need that I have personally worked with and vetted.

Quick Valuation Assessment

Answer 17 questions/value drivers to quickly estimate your Capitalization Rate to let you know how ready you are to exit your business.

Business coaching will help you define your goals and implement the plan so that you will be ready on your terms and timeline!